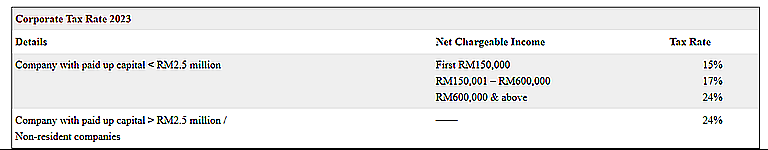

15% TAX RATE (NEW COMPANY RATE 2023/2024)

Corporate Tax Rate 2023

Condition to get the 15% lowest tax rate:

- Must be Malaysian resident company

- Paid-up capital below RM 2.5 mil

- Revenue not more than RM 50 mil

- If the company has a holding company, the holding company need to be SME

1. Condition of resident companies

- Not more than 20% of its paid-up capital in respect of ordinary shares is being owned by one or more foreign companies, either directly or indirectly.

- Not more than 20% of its paid-up capital in respect of ordinary shares is being owned by one or more individuals who are non-Malaysian citizens, either directly or indirectly.

*This regulation will come into effect in 2024*

2. Holding company

In a simple word, a holding company refers to a company that has controlling power against the other company by holding over 50% of their shares. For example, Company A obtains over 50% of Company B’s shares, Company A is the holding company to Company B.

MALAYSIA

Corporate - Taxes on Corporate Income

Last reviewed – 27 June 2023

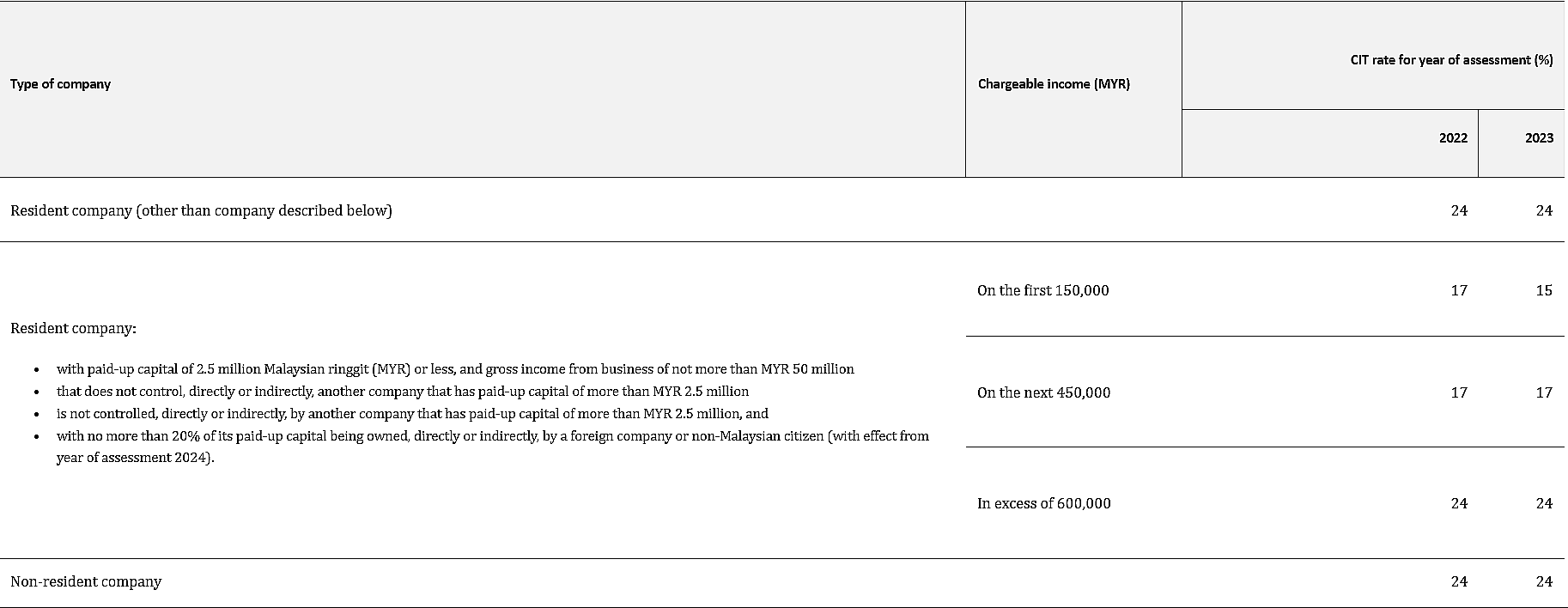

For both resident and non-resident companies, corporate income tax (CIT) is imposed on income accruing in or derived from Malaysia. Resident companies are also taxed on foreign-sourced income received in Malaysia. The current CIT rates are provided in the following table:

For year of assessment 2022 only, a special one-off tax at the rate of 33% is imposed on companies, excluding companies that enjoy the 17% reduced tax rate above, that have generated high income during the COVID-19 pandemic, on the portion of chargeable income in excess of MYR 100 million.

Petroleum Income Tax

Petroleum income tax is imposed at the rate of 38% on income from petroleum operations in Malaysia. An effective petroleum income tax rate of 25% applies on income from petroleum operations in marginal fields. No other taxes are imposed on income from petroleum operations.

Local Income Taxes

There are no other local, state, or provincial government taxes on income in Malaysia.