How to Pay Withholding Tax Online?

Withholding Tax Submission

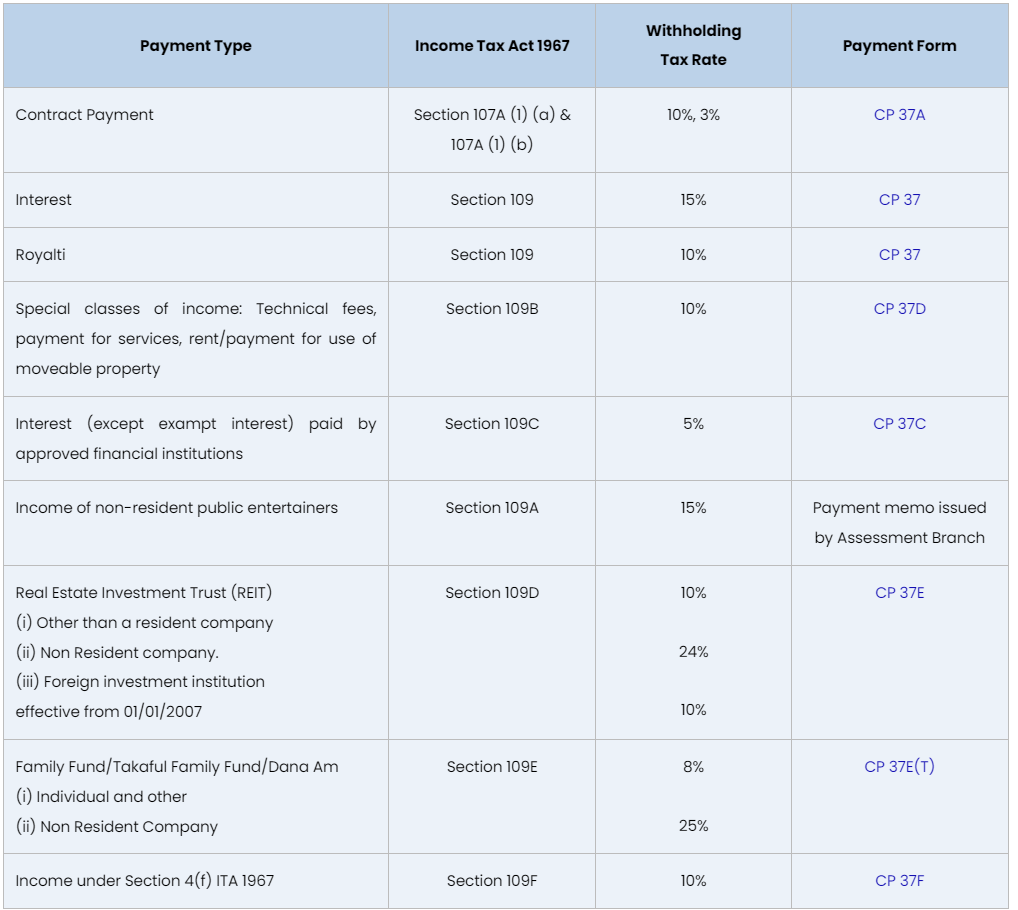

Kindly fill up the necessary forms. You may download the forms from LHDN website, https://www.hasil.gov.my/en/legislation/withholding-tax/

*Googles & FB advertisement is fall under Royalty categories

*Googles & FB advertisement subject to 8% of WHT

2. Proceeds for payment as below:-

(a) Access to https://ett.hasil.gov.my/

(b) Key in your information -> Teruskan

(c) Key email to received OTP code, and key in OTP code to proceed further

(d) Select type of payment & section

(e) Key in payer information (Your Company details)

(f) Key in recipient information (Your Supplier details)

* the income tax number of your supplier have to request from LHDN

(g) Key in payment details

Tarikh bayaran telah dibayar | – Payment date to your supplier |

Kadar | – WHT rate (can check from LHDN website) |

Amount cukai pegangan | – Witholding tax amount |

Amaun Kasar | – Amount as per supplier invoice |

Amaun Bersih | – Amount as per supplier invoice |

(h) Proceed accordingly, the website will generate “e-TT verification slip” to you as below:-

(i) Login to your bank account, and proceed for payment. VA no. will be the recipient account number for your payment.

(j) Email officer (whtoperasi@hasil.gov.my) with all the documents stated as below:-

- Signed CP37

- Supplier invoice

- e-TT verification slip

- Payment slip

(k) Save all the files as part of your supporting for payment.